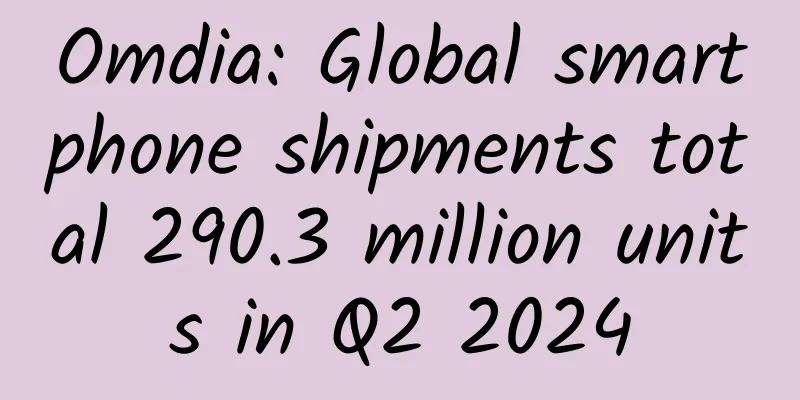

Omdia: Global smartphone shipments total 290.3 million units in Q2 2024

|

According to the latest Omdia smartphone shipment forecast report, shipments in the second quarter of 2024 will total 290.3 million units. Compared with the previous year, it achieved a year-on-year growth of 9.3% and a slight decline of 3.2% month-on-month, but this data still reveals the growth trend of the smartphone market after experiencing fluctuations. Data shows that traditional giants such as Samsung and Apple still maintain their leading position, and continue to consolidate their market position with their strong brand influence and technological strength. Samsung, with its extensive global market presence and diversified product lines, topped the list with 53.7 million units shipped, up 0.7% from the second quarter of last year but down 11.2% from the first quarter due to seasonal factors, with mid-range units priced between US$250 and US$600 accounting for a large proportion. Apple followed closely with 45.6 million units shipped and a market share of 16%, up from 43.2 million units in the second quarter of 2023, but down from 50.7 million units in the first quarter of 2024. Although Apple's overall shipments increased year-on-year, shipments in Greater China declined compared to the same period last year. According to Apple's third-quarter financial report for fiscal year 2024, Apple's total net sales in the third quarter were US$85.777 billion, a 5% increase from US$81.797 billion in the same period last year, a record high, and net profit was US$21.448 billion, an 8% increase from US$19.881 billion in the same period last year. Among them, iPhone revenue was $39.296 billion, down 0.9% year-on-year, but still higher than analysts' expectations. iPad revenue increased by 23.7% to $7.162 billion. Mac revenue was $7.009 billion, up 2.4% year-on-year. Although Apple's overall shipments increased year-on-year, its market performance in Greater China was disappointing. Apple's revenue in Greater China in the third fiscal quarter was US$14.728 billion, down 6.5% from US$15.758 billion in the same period last year. Although Apple has frequently cut prices in the domestic market to stimulate demand, its shipments have not escaped the dilemma of year-on-year decline. IDC data also shows that in the second quarter of 2024, Apple's share of the Chinese smartphone market ranked sixth, and its shipments fell year-on-year, falling out of the top five for the first time. Some analysts believe that this result is due to factors such as the continued increase in competitiveness of domestic brands and Apple’s own channel adjustments. Back to Omdia's data, domestic mobile phone manufacturers have also performed very well in the global market. Brands such as Xiaomi and vivo have achieved significant growth in shipments. They not only occupy an important position in the domestic market, but are also actively expanding in overseas markets. Thanks to its advantages in cost-effectiveness, Xiaomi's shipments increased from 33.2 million units in the second quarter of last year to 42.3 million units in the second quarter of this year, a slight increase of 3.7% from the previous quarter, accounting for 14.1% of the global shipment share in the first half of 2024. Vivo's shipments increased slightly from 24.5 million in the second quarter of 2023 to 26 million in the second quarter of 2024 through product innovation and market expansion. OPPO's shipments in the second quarter were 25.2 million units, an increase of 1% from the second quarter. The steady increase in overseas shipments led to growth in global shipments. Honor's shipments were 15.5 million units, up 9.9% from 14.1 million units in the second quarter of 2023. This is the fourth consecutive quarter that Honor has achieved year-on-year growth. Motorola and Realme also maintained growth in shipments. Huawei's shipments totaled 11.7 million units, up 58.1% year-on-year, making it the fastest growing among the top ten smartphone manufacturers. According to market trends, the smartphone market is experiencing accelerated polarization, with the proportion of low-end and high-end markets increasing, while the mid-range market is shrinking . Different brands have different performances, with some achieving substantial growth and others facing challenges. But overall, the market structure is becoming more polarized. Tianji.com |

<<: We Are Social: Global Digital Report 2023

>>: Combining Chinese and Western medicine to treat acute attacks of chronic bronchitis

Recommend

I feel dizzy when I wake up from a nap. What’s going on?

A netizen asked: In the past few days, during lun...

[Medical Q&A] I have psoriasis. Will it be contagious to my family?

Planner: Chinese Medical Association Reviewer: Li...

Diabetes injections only needed three times a year

Engineers at Stanford University in the United St...

What happens if you have sex before your period?

Many couples are concerned about getting pregnant...

Is insomnia caused by insomnia? Experts: There are four major criteria for diagnosing insomnia

The China Sleep Research Society recently release...

CNIT: Mobile music APP downloads and month-on-month growth at the end of April 2014

China IT Research Center (CNIT-Research) has comp...

What causes women’s weak legs and feet?

Women feel sore and weak legs and feet. Although ...

Causes and prevention of skin itching in hemodialysis patients

1. Common causes Accumulation of uremic toxins In...

Hypertension management in young people: a compulsory health course that cannot be ignored!

In the traditional public perception, high blood ...

The process of belly enlargement during pregnancy

It is not easy for women to conceive. During the ...

Causes of vaginal itching after sex

Many women will find a phenomenon that makes them...

What are the methods of treating dysmenorrhea in traditional Chinese medicine?

Modern medicine believes that any lower abdominal...

What causes bleeding after sex during pregnancy?

It is best for women not to have sex in the early...

What are the ways to maintain women's uterus?

Women should pay attention to their physical heal...

What is cervical echogenicity?

In addition to the more frequent examinations dur...